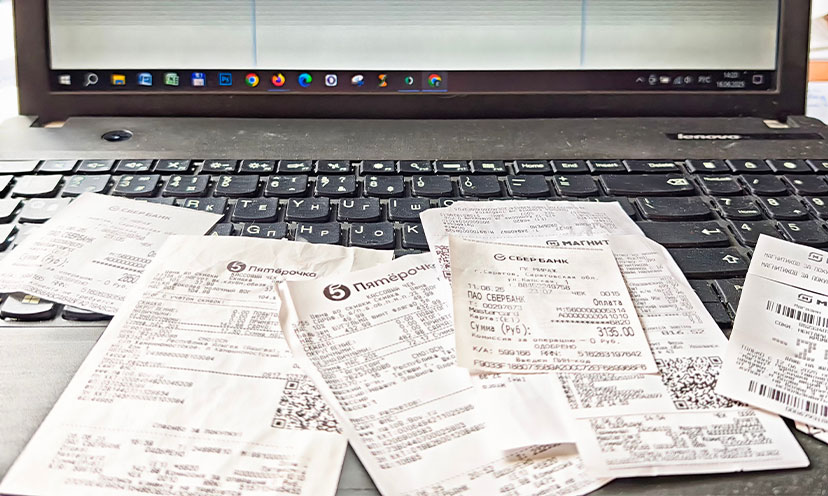

Getting organized for tax season doesn’t have to be a frantic scramble every April. With a strategic year-round approach, you can transform tax preparation from a stressful ordeal into a manageable process. Here’s your systematic guide to staying ahead of the paperwork game.

Create Your Foundation: The Document Storage System

Start with a dedicated space for all tax-related documents. Whether you choose a physical filing system or digital storage, consistency is key. Set up separate folders for:

- Income documents (W-2s, 1099s, business income records)

- Deduction receipts (medical expenses, charitable donations, business expenses)

- Investment statements (brokerage accounts, retirement contributions)

- Property records (mortgage interest, property taxes, home improvements)

- Business documents (receipts, mileage logs, equipment purchases)

For digital storage, cloud-based solutions like Google Drive or Dropbox offer accessibility and automatic backup. Physical filers should invest in a quality filing cabinet with clearly labeled folders.

Monthly Maintenance Tasks

Each month, dedicate 30 minutes to tax document management:

Week 1: Collect and file all receipts from the previous month. Sort business expenses, medical bills, and charitable donations into their respective folders.

Week 2: Review bank and credit card statements for any tax-relevant transactions you might have missed. Download digital statements if you’re maintaining electronic records.

Week 3: Update your mileage log if you claim vehicle deductions. Business owners should reconcile expense reports and ensure all business purchases are properly documented.

Week 4: Scan and store any paper documents you’ve accumulated. Delete duplicates and ensure file names are clear and searchable.

Quarterly Review Process

Every three months, conduct a deeper review of your tax document system:

- Verify all investment statements are properly filed

- Review estimated tax payments and ensure documentation is complete

- Check that business quarterly reports align with your collected receipts

- Update your deduction tracking spreadsheet with running totals

- Assess whether you’re on track to meet annual contribution limits for retirement accounts

This quarterly checkpoint helps identify any missing documentation while there’s still time to obtain replacements.

Essential Tools and Technologies

Several tools can streamline your organization process. Receipt-scanning apps like CamScanner or Adobe Scan convert paper receipts into searchable PDFs. Mileage tracking apps automatically log business travel, eliminating the need for manual record-keeping.

For business owners, accounting software like QuickBooks or FreshBooks integrates directly with bank accounts, automatically categorizing expenses and generating reports. Even simple spreadsheet templates can significantly improve organization for individuals tracking deductions.

Year-End Preparation Strategy

As December approaches, shift into preparation mode:

- Request missing documents from employers, banks, or investment firms

- Compile charitable donation records and verify non-cash contributions are properly valued

- Gather all Form 1099s and ensure they match your records

- Organize business expense receipts by category

- Review the previous year’s tax return to identify any recurring deductions you might have overlooked

Your Action Plan

Start implementing this system immediately, regardless of the time of year. Begin with creating your folder structure, then establish the monthly maintenance routine. The key to success lies in consistency – spending a small amount of time each month prevents the overwhelming accumulation of documents.

Remember, organized records don’t just make tax preparation easier; they also provide crucial documentation for audits, loan applications, and financial planning. Your future self will thank you for the systematic approach you implement today.