Want your money to grow while you sleep? That’s the magic of compound interest. It’s a powerful financial tool that can help you build wealth over time, even if you’re not investing huge amounts.

What Is Compound Interest?

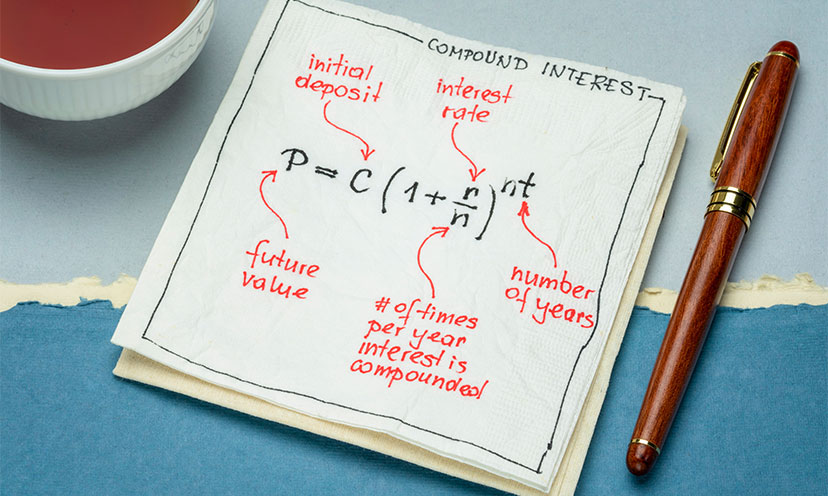

In simple terms, compound interest is when you earn interest on both the money you’ve saved (called the principal) and the interest that money has already earned. Over time, this creates a snowball effect: your money earns more and more without any extra effort on your part.

Let’s say you put $1,000 in an account that earns 5% interest each year. After the first year, you’ll have $1,050. In the second year, you’ll earn 5% on $1,050—not just your original $1,000. That means you’ll earn $52.50, not just $50. The difference may seem small at first, but over years or decades, it really adds up.

The earlier you start, the more time compound interest has to work its magic.

Accounts That Use Compound Interest

There are several types of accounts that let you take advantage of compound interest. Here are the most common ones:

1. High-Yield Savings Accounts

These accounts earn more interest than a regular savings account. They’re usually offered by online banks and compound interest daily or monthly. They’re great for emergency funds or short-term savings goals.

2. Certificates of Deposit (CDs)

A CD is a savings product where you lock your money in for a set time (like 6 months or 1 year) in exchange for a higher interest rate. The bank pays compound interest during that period. These work best when you know you won’t need the money right away.

3. Money Market Accounts

These are similar to savings accounts but often offer slightly higher interest rates and limited check-writing abilities. Interest usually compounds daily or monthly.

4. Retirement Accounts (like IRAs and 401(k)s)

While these aren’t interest-based accounts, they still grow with compound returns: thanks to reinvested dividends and growth in the investments inside them. The longer your money stays invested, the more you benefit from compounding.

Final Thoughts

Compound interest rewards patience and consistency. Even small, regular deposits can grow significantly over time. The key is to start early, stay consistent, and let time do the heavy lifting.

If you’re not using an account that earns compound interest, it m